H1: Reducing Regulatory Compliance Expenses

Read Now : Equitable Algorithm Design Strategies

In today’s fast-paced business world, reducing regulatory compliance expenses has become a significant objective for organizations looking to improve their financial performance. The mounting layers of regulations can often feel like an endless maze of red tape, putting a strain on both time and resources. Imagine being on a rowing team where every member must operate in perfect sync, but then the task becomes navigating a labyrinthine course, dodging numerous obstacles—a fitting analogy for the tedious process of regulatory compliance. The good news is, much like rowing, with the right strategies, direction, and rhythm, your organization can glide smoothly through the complex waters of compliance, emerging successfully while minimizing costs.

Regulatory compliance may seem like a daunting challenge, akin to tackling Mount Everest for companies. The vast amount of paperwork, countless reports, and constant changes in legislation can be overwhelming, especially for smaller businesses that do not have the luxury of dedicated compliance teams. Finding innovative and effective methods to reduce these expenses is like discovering a treasure chest at the bottom of the sea—immensely valuable. Many organizations are embracing digital solutions, automating compliance reporting, and integrating systems to better organize and streamline processes, cutting down costs significantly in the process.

While adopting technology is a popular and effective way to reduce these expenses, there is no one-size-fits-all solution. Each business must evaluate its own context—its size, industry, and specific regulatory requirements—and then tailor its approach accordingly. The key is to transform regulatory compliance from a burden into a strategic advantage. By reallocating resources more efficiently and focusing on essential regulatory tasks, businesses not only curb their compliance costs but also improve their core operational processes, ultimately leading to healthier profit margins.

H2: Strategies for Reducing Regulatory Compliance Expenses—Introduction

In the ever-evolving landscape of business regulations, reducing regulatory compliance expenses is not just an option but a necessity. Businesses today find themselves entangled in a web of regulatory requirements that can siphon away resources, time, and focus. But fear not, there are practical and strategic approaches to navigate these regulations like a pro, unleashing potential savings and efficiencies that can transform the way you conduct business.

One might compare the task of reducing regulatory compliance expenses to managing a closet full of clothes. It starts with understanding what you have—identifying outdated practices, redundant processes, and unnecessary checks—and then streamlining and optimizing your operations much like organizing your wardrobe. This not only opens up space but also brings clarity and efficiency, letting you focus on what really matters: driving your business forward.

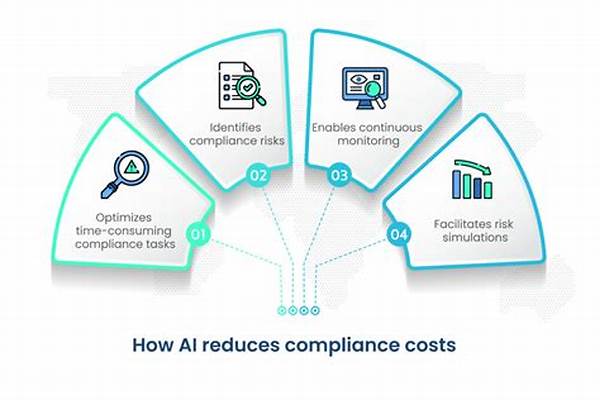

Leveraging technology can serve as your secret weapon in this endeavor. Innovations like artificial intelligence and machine learning can automate routine compliance tasks, ensuring accuracy while significantly cutting down on man-hours and related costs. Think of it as hiring a virtual assistant who never sleeps, never eats, but is always on top of the paperwork. By doing so, businesses can stay ahead of the compliance curve without breaking the bank.

Adopting a proactive stance towards compliance can also mitigate risks and save costs. Much like investing in preventive healthcare to avoid costly treatments down the line, early identification of compliance issues prevents them from ballooning into major financial burdens, leaving your business healthier and more robust.

H2: The Role of Technology in Reducing Compliance CostsH3: Embracing Automation in Compliance Management—Detailed Points on Reducing Regulatory Compliance Expenses

Reducing redundancy in compliance procedures can lead to better resource allocation.

Utilize software tools for data management and compliance reporting.

Frequent audits help identify inefficiencies and potential issues before they escalate.

Hiring experts in compliance may save money in the long run by avoiding fines and reducing inefficiencies.

Regular training programs ensure employees are up-to-date with the latest compliance requirements.

Description

In the intricate dance of business operations, reducing regulatory compliance expenses is rapidly becoming a crucial element for maintaining competitiveness. Much like navigating a ship through rocky waters, businesses today need to find efficient and cost-effective routes to tackle their regulatory obligations. By embracing digital transformations that include automation tools and robust data management practices, businesses can significantly cut down on compliance costs. Just as a traveler uses a map, leveraging data-driven insights can lead to more informed decisions, reducing unnecessary expenditure.

Embracing technology is akin to shifting from a typewriter to a high-speed computer—it’s about optimizing operations to save both time and money. Moreover, a culture of ongoing training and awareness not only prepares employees to handle compliance with finesse but also fosters a proactive environment where potential risks are identified early, allowing for calculated and timely responses.

As businesses look to the future, reducing compliance costs should be seen not just as a means to cut expenses but as a strategic initiative that can drive growth. By reallocating saved resources towards innovation and core business areas, companies can enhance their market position and ensure long-term success.

—H2: Navigating the Compliance Maze: A Roadmap to SavingsH3: Technological Tools for Effective Compliance Management

In an environment where regulations can shift as frequently as times and tides, reducing regulatory compliance expenses has become a vital goal for businesses worldwide. Navigating the intricate regulatory landscape demands not just adherence to the law, but also strategic foresight and innovation. The road to achieving reduced compliance costs is paved with both challenges and opportunities—think of it as an adventurous hike through an amazingly picturesque yet precarious mountain range.

Read Now : Unsupervised Time Series Anomaly Models

Strategically, reducing compliance expenses begins with conducting a thorough audit of existing processes. This serves as both a diagnosis and a prescription, identifying areas where efficiency can be improved and costs reduced. Imagine it as refurbishing an old and creaky bridge; the process might seem cumbersome initially, but the safety and security it offers afterward prove invaluable.

Further bolstering these strategies, technology acts as the cornerstone of modern compliance management. Automated systems can significantly lessen the manual burden, freeing up human capital and reducing the likelihood of costly errors. It’s like having a digital swiss-army knife at your disposal, ensuring that every compliance need is met without opening your organization to unforeseen expenditures.

On the emotional spectrum, fostering a compliance-conscious culture within the company aligns all departments towards consistent policy adherence. This does not just assure regulatory satisfaction but also builds employee confidence and enhances organizational reputation. It’s having the entire team rowing in synchrony, ensuring that the business sails smoothly through the compliance sea.

H2: Practical Tools and Solutions for Managing Compliance CostsH3: Making the Most of Cost-Effective Compliance StrategiesTips for Reducing Regulatory Compliance Expenses

Foster an organization-wide commitment to compliance as part of the company’s ethos.

Regular sessions for employees to stay updated on compliance changes.

Regularly auditing compliance processes to identify areas of improvement.

Leverage automation and data analysis tools for efficient compliance management.

Consider third-party expertise to handle complex compliance requirements.

Develop strategies that focus on minimizing compliance-related risks.

Create a strategic plan that aligns compliance activities with business goals.

Ensure regular updates and feedback loops between compliance officers and the rest of the staff.

Implement and monitor key performance indicators to track compliance efficiency.

Engage with regulators to gain insights and clarity on compliance expectations.

In the bustling world of business, navigating the regulatory maze can sometimes feel like attempting to herd cats—chaotic and challenging. However, effectively reducing regulatory compliance expenses is akin to investing in a high-quality GPS; it provides direction, saves time, and ultimately reduces costs. Whether it’s through harnessing technological advancements such as automation, conducting regular audits, or fostering a compliance-first culture within the organization, each step taken is a stride toward greater financial efficiency.

A cornerstone of these efforts is fostering an environment where compliance is viewed not as an obligatory burden but as a core component of business strategy. Key to this transformation is understanding that every dollar saved on compliance can be redirected to areas with growth potential, pushing the business farther and faster than ever before. Think of it as redistributing the crew’s effort from rowing against the current to catching the wind in the sails—the journey becomes not only possible but profitable.

It’s clear that firms committed to reducing these expenses stand on a more competitive footing, enabling them to innovate, expand, and succeed in their respective markets. With the proper fusion of technology, strategic planning, and cultural resonance, reducing regulatory compliance expenses is not just a goal but a tangible reality that pays dividends in every aspect of business.