Predictive Modeling for Risk Analysis

In the bustling world of modern business, where uncertainty is the only certainty, understanding and mitigating risk is paramount. Imagine driving down a foggy road. You would rely on your car’s headlights to navigate safely, wouldn’t you? Similarly, in business, we deploy predictive modeling for risk analysis to light the way. This powerful tool allows companies to foresee potential risks and strategize effectively to prevent hiccups that could hamper growth. Want to discover how it works and why it’s taking the business world by storm? Hold onto your hats, because we’re diving deep into the world where data meets foresight.

The Art of Anticipation

Predictive modeling for risk analysis isn’t just about reading the tea leaves of data; it’s about understanding what those leaves mean for future business landscapes. By harnessing statistical algorithms and machine learning techniques, businesses can predict potential hurdles and opportunities. Sounds like sorcery, right? But it’s really just data science making itself useful. Organizations now can anticipate customer behavior, economic shifts, and even fluctuations in market trends. Imagine knowing when a storm is coming so you can close your windows in advance—this is the advantage predictive modeling offers. It’s your crystal ball, only more reliable and a lot less mystic.

Risk Analysis Reimagined

In the past, assessing business risks involved a lot of guesswork, making it a bit like betting on a long shot at the races. Now, with predictive modeling for risk analysis, companies have access to more accurate, reliable data that ensures well-informed decisions. An organization can create simulations based on historical data, identifying key indicators that pave the way to potential risks. Suddenly, risk management isn’t a guessing game—it’s a precise science. Firms can develop strategies with confidence, knowing that their decisions are backed by solid data and analysis.

Predictive Models: The Game Changer

What makes predictive modeling for risk analysis a game-changer? It’s the marriage of technology and insight—an unstoppable duo that’s turning business risk into business opportunity. With companies like Netflix predicting viewing habits or Amazon anticipating purchasing trends, it’s easy to see how these models go beyond merely managing risk to creating pathways of opportunity. In effect, they allow businesses to do more than just survive; they empower them to thrive in an evolving marketplace. So, are you ready to step into the future with predictive modeling for risk analysis?

The Role of Machine Learning in Predictive Modeling

Not to be left out, machine learning plays a critical role in predictive modeling for risk analysis. By expertly sifting through mountains of data, these intelligent algorithms identify patterns and trends that even the most eagle-eyed analysts might miss. It’s this ability to learn and adapt that sets machine learning apart, making it a crucial ally in the quest for effective risk management.

—

Goals of Predictive Modeling for Risk Analysis

Understanding the full potential of predictive modeling for risk analysis begins with defining its primary goals. As businesses expand their horizons, they must identify and manage potential pitfalls. This process involves drawing comprehensive risk maps to predict possible scenarios. These maps aren’t etched on parchment with quills but developed through complex algorithms and a dash of business savvy. This means it’s easier to visualize risk landscapes and strategize accordingly, ensuring enterprises not only survive but advance in the competitive game.

Enhancing Decision-Making

One vital goal of predictive modeling for risk analysis is enhancing decision-making capabilities. Why flip a coin when you can have data-backed insights? This model allows companies to make decisions based on precise analysis rather than gut feelings. Businesses are empowered to focus resources where they are most needed, ensuring an optimized approach to growth and sustainability. Besides, who doesn’t like the idea of minimizing surprises in the business world? With predictive modeling, it’s like having your very own crystal-clear GPS guiding your journey.

Building Resilience with Predictive Models

Think of predictive models as the insurance policy your business didn’t know it needed. By anticipating challenges and preparing for them, companies build resilience. This ability to adapt quickly to changing situations is priceless in today’s fast-paced market. It’s not just about surviving the storm; it’s about dancing in the rain, turning every challenge into a new opportunity to shine. With predictive modeling for risk analysis, resilience is not just a buzzword—it’s a strategy.

Reducing Costs and Increasing Efficiency

Not only do predictive models prepare companies for potential risks, but they also help reduce costs. By anticipating inefficiencies, businesses can eliminate waste, streamline operations, and focus on what really matters. This focus leads to experiencing fewer disruptions and saving more resources. Thanks to predictive modeling for risk analysis, your business operations can be as smooth as your ideal morning coffee run—without the unexpected detours.

—

Summary Points on Predictive Modeling for Risk Analysis

—

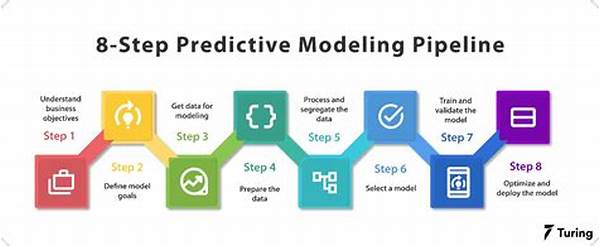

Discussion on the Mechanisms of Predictive Modeling for Risk Analysis

The mechanics behind predictive modeling for risk analysis are as fascinating as they are effective. The process begins with data collection; vast amounts are gathered and organized from numerous sources. Imagine it as a giant puzzle with pieces scattered worldwide. Once these pieces are gathered, the real magic begins—cleaning and preparing the data for analysis. This step is crucial because, like baking, even the smallest ingredient misstep can ruin the entire batch.

The Intricacies of Data Processing

Once collected, the data undergoes rigorous processing. Techniques such as normalization and categorization ensure that it’s in top shape to feed the hungry algorithms. This stage is akin to polishing a raw gem into something magnificent. After all, refined data is the foundation upon which predictive models for risk analysis are built. This step is both an art and a science, requiring a skilled data analyst’s meticulous eye for detail.

Algorithms at Work

With data primed for action, algorithms take center stage. These clever mathematical models work tirelessly, identifying patterns and potential outcomes. Think of them as your business’s personal team of detectives, solving mysteries and unveiling insights. They assess trends and correlations that can forecast potential risks, issues, or opportunities. And much like Sherlock Holmes, their deductions rarely miss the mark. Predictive modeling, driven by these algorithms, becomes a powerful tool that any business can wield to its advantage.

Taking Action from Results

The final stage involves interpreting and acting on the results. It’s like getting the keys to a new car and finally taking it for a spin. Decision-makers analyze the insights garnered and plan strategic moves. In this sense, predictive modeling for risk analysis not only highlights risks but also illuminates paths worth taking. A business can then navigate risks with agility and precision, ready for whatever the future holds. Armed with data and analysis, companies are ready to write their success stories.

—

Illustrations Relevant to Predictive Modeling for Risk Analysis

—

Predictive modeling for risk analysis is the unsung hero of the modern business environment. From enhancing decision-making to streamlining operations, its influence permeates every facet of an organization. The insights derived through this powerful methodology make the once impossible task of predicting the future not only feasible but efficient. In essence, it’s less about predicting outcomes and more about preparing for them. Embracing this approach can mean the difference between thriving and merely surviving in an increasingly uncertain world.

Predictive modeling for risk analysis transforms raw data into actionable insights, empowering businesses with the knowledge they need to make informed decisions. Through its intricate processes, from data collection to algorithmic analysis, it provides a strategic advantage that’s hard to overlook. Therefore, businesses aiming for sustainability and success would be wise to adopt and adapt to the potentials predictive modeling offers. The future beckons, and with predictive modeling, you’re more than equipped to answer the call.

By adopting predictive modeling for risk analysis, organizations can navigate the ever-evolving market landscape with confidence and precision. Instead of wondering about the next big change, they’ll already be prepared to embrace it. This methodology doesn’t just predict risk; it creates opportunities, turning obstacles into pathways for growth. So, as you contemplate the next steps for your business, consider the undeniable potential of predictive modeling for risk analysis. It just might be the compass you need in a sea of uncertainty.