In the evolving world of technology and data, businesses, and individuals constantly seek reliable methods to evaluate and mitigate risks. Neural Networks for Risk Evaluation have emerged as a game changer in this regard, providing sophisticated analysis and prediction capabilities that surpass traditional methods. The application of neural networks—mimicking the human brain’s neural architecture—allows for profound insights into potential risks, ultimately enhancing decision-making processes and safeguarding against potential pitfalls in dynamic market environments. This article delves into the potential of neural networks for risk evaluation, highlighting their unique selling points and the transformative role they can play in risk management strategies.

Read Now : Unsupervised Time Series Anomaly Models

From finance to healthcare, the applicability of neural networks in risk evaluation spans various sectors, showcasing a blend of creative and analytical prowess in modern technology. Neural networks have demonstrated a remarkable ability to process vast amounts of data, discern patterns, and predict outcomes with a level of accuracy that aids in managing potential risks effectively. Businesses capitalizing on these insights can outperform competitors by predicting market trends, understanding customer behaviors, and identifying potential threats before they materialize.

The beauty of neural networks lies not just in their complexity but also in their capacity for continuous learning and adaptation. As markets evolve, so do these networks, offering an exclusive edge to users who invest in this cutting-edge technology. Whether you’re an entrepreneur looking to enhance your business acumen or part of a large corporation aiming to fortify existing risk management frameworks, integrating neural networks could be your golden ticket to success.

How Neural Networks Transform Risk Evaluation

The transformation brought by neural networks in risk evaluation stems from several core capabilities. Primarily, these networks enhance predictive accuracy by learning from historical data and understanding nuanced patterns that might be invisible to human analysts. This predictive prowess translates into proactive risk management, allowing businesses to navigate uncertain conditions with confidence. Additionally, neural networks have improved reaction times in risk assessment processes, offering swift responses to potential threats, thereby minimizing disruptions and optimizing strategic planning.

—

Introduction to Neural Networks for Risk Evaluation

In today’s hyper-competitive markets, neural networks for risk evaluation serve as the backbone of strategic planning, helping enterprises maneuver through complex data landscapes with unprecedented precision. The essence of neural networks lies in their ability to mimic human cognitive functions, thereby processing data in a way that uncovers deep insights and allows for dynamic risk evaluation across myriad scenarios.

The beauty and complexity of neural networks are akin to the bustling energy of a metropolis—chaotic yet highly structured, enabling businesses to sift through the noise and concentrate on what matters. This aspect is especially relevant in risk management, where discerning subtle connections between variables can make or break a decision. Whether it’s predicting stock market shifts or assessing credit risks, neural networks prove indispensable.

Successful risk evaluation isn’t just about identifying potential threats but also about leveraging opportunities for growth. This brings to light the emotional and rational elements that drive sound business decisions, facilitated by the use of neural networks. Through anecdotal storytelling and concrete testimonials from industry leaders, a persuasive case emerges for why organizations should embrace these technological advances.

Analyzing the Scope of Neural Networks in Risk Management

In interviews with top executives and data analysts, the consensus points toward a future dominated by AI and neural networks as key tools for risk mitigation. Their role isn’t limited to prediction alone but expands into effective strategy implementation—transforming raw insights into actionable plans aimed at fostering organizational resilience.

Embracing neural networks for risk evaluation comes down to understanding their unique selling proposition: adaptability and continuous learning. For businesses, this translates into a competitive advantage—consistently outperforming those reliant on static methods. As markets and technologies evolve, networks evolve too, ensuring relevance and precision in risk assessment.

By combining creative and analytical perspectives, neural networks unlock new interpretations of data, paving the way for innovative solutions in risk evaluation. This blend of creativity and logic is what makes neural networks invaluable in modern-day industries, rendering them a cornerstone in effective risk management strategies.

How Neural Networks Deconstruct Traditional Risk Models

As investigations into traditional risk management reveal limitations, neural networks offer a refreshing alternative with enhanced capabilities. The interpretative power of these networks redefines risk assessment by focusing on dynamic variables and continuous improvement—key elements in circumventing potential business threats.

Integrating neural networks into existing processes isn’t merely a trend but a necessity, driven by the explicit demand for accuracy and efficiency in risk evaluation. This technological transformation holds significant promise for businesses willing to adapt, promising exclusive insights, robust decision-making, and sustained competitive advantage.

—

Objectives in Neural Networks for Risk Evaluation

Harnessing Neural Networks to Revolutionize Risk Management

The neural networks’ ability to manage vast quantities of data with pinpoint accuracy positions them as invaluable assets within the domain of risk evaluation. By streamlining the analysis process, these networks drastically reduce the time it traditionally takes to assess risks, empowering businesses to make informed decisions at an unprecedented pace.

A noteworthy feature is their adaptability. Unlike static algorithms that require constant manual adjustments, neural networks learn from each data input, continually enhancing their forecasting capabilities. This continuous learning aspect bestows them with an edge, making them effective in an ever-evolving marketplace characterized by volatility and uncertainty.

Through compelling storytelling, industry leaders share testimonials on how neural networks have fortified their risk management strategies, showcasing tangible benefits such as cost reduction, enhanced compliance, and improved market positioning. This real-world impact underscores the crucial role of neural networks in shaping the future of risk evaluation.

Furthermore, the cost-effectiveness of fully integrating neural networks into existing systems assures businesses of sustainable growth. By coupling emotional and rational elements in a company’s risk strategy, neural networks foster a holistic approach that transcends conventional risk evaluation models, thereby steering organizations toward long-term success.

Read Now : Transparent Algorithms For Trust Building

The Road Ahead for Neural Network Adoption

While the integration journey might appear daunting, the potential rewards far outweigh the initial effort. Companies launching initiatives to incorporate neural networks into their risk management fabric stand to gain a remarkable competitive advantage, not only through immediate enhancements in risk assessment but also through long-term strategic benefits.

With growing evidence supporting their efficacy, neural networks are rapidly becoming indispensable in revolutionizing how businesses approach risk evaluation. The path is clear for forward-thinking organizations willing to invest in cutting-edge technologies and reimagine their approach to risk and opportunity management.

—

Illustrations of Neural Networks for Risk Evaluation

Transforming Risk Evaluation with Neural Network Technologies

In the rapidly shifting market landscape where data is king, companies keen on refining their risk management strategies now turn to neural networks for risk evaluation. These technologies bring about transformative shifts in how organizations identify and manage potential risk factors, ensuring that opportunities aren’t lost in the shuffle of finding the next big threat. With neural networks, the focus shifts from mere response to proactive mitigation.

As businesses deal with increasing data complexities, the implementation of neural networks enables a seamless transition from traditional risk models to more dynamic, adaptive systems. By effectively analyzing risk data, neural networks produce actionable insights, allowing companies to gain a deeper understanding of potential vulnerabilities and opportunities alike.

By employing neural networks in risk evaluation, businesses can respond more adeptly to emerging trends and threats, ensuring long-term resilience amidst uncertain markets. Their nuanced ability to capture intricate data patterns not only helps avert risks but also encourages a culture of strategic innovation and better informed decision-making.

The growing body of research and success stories surrounding neural networks for risk evaluation serves as a powerful testimony to their effectiveness, marking a new dawn in predictive risk management. For businesses ready to harness the future of AI-driven insights, the journey begins now, with neural networks as the trusted guide toward a robust risk management regime.

—

Short Article on Neural Networks for Risk Evaluation

In today’s data-driven age, the reliance on neural networks for risk evaluation has revolutionized how businesses approach risk management. Mimicking the synaptic connections of the human brain, these networks delve deeper into data analytics, generating insights that traditional models may miss. The advent of neural networks signifies a shift in paradigm from static analysis to a dynamic, learning-based model capable of adapting to new inputs continuously.

The traditional linear approach in risk management is becoming obsolete. Neural networks provide a nonlinear predictive model, which means they can decipher complex patterns and relationships within vast datasets. This feature empowers businesses, enabling them to address potential threats with greater accuracy and agility. For industries such as finance, healthcare, and logistics, this marks a stark evolution, minimizing losses and maximizing opportunities.

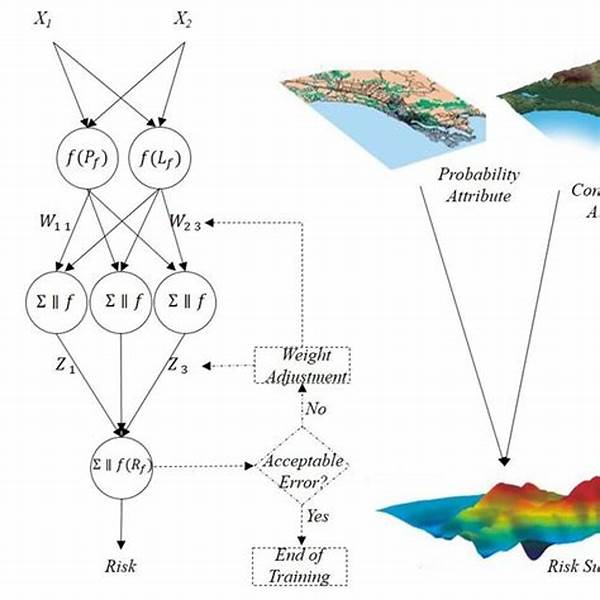

The Mechanics Behind Neural Networks

Neural networks operate through layers of interconnected nodes, constructing models where the system learns to predict outcomes or classify data through experience. This process resembles the human brain, allowing the network to improve as more data becomes available. The implications of this technology in risk evaluation cannot be understated—offering enhanced predictive insights that are crucial in making informed strategic decisions.

Elevating Business Strategies with AI

When neural networks are integrated into risk management strategies, businesses not only mitigate risks more effectively but also transform potential threats into growth opportunities. Through AI-driven insights, companies can unravel complex market behaviors, devise precise strategies, and ultimately outsmart competitors.

For those ready to embrace the future of risk assessment, the potential benefits of neural networks are compelling. This forward-thinking technology promises profound insights and strategic roadmap transformations, rendering it a valuable ally in navigating today’s competitive landscape.

Overall, neural networks for risk evaluation have emerged as a formidable tool, one that businesses would be wise to incorporate. By leveraging the power of AI, organizations position themselves at the forefront of innovation—arming themselves against uncertainty with unmatched precision and agility.