Hey there, fellow readers! Ever wondered about the intriguing world of legal risk prediction models? It’s a bit of a mouthful, but don’t fret! As we dive into this topic, think of it as mixing science with the courtroom drama we all secretly love. These models are like crystal balls for legal eagles, helping lawyers and businesses foresee potential risks before they become courtroom nightmares. With technology advancing faster than a lawyer on caffeine, these models are quickly becoming the unsung heroes of the legal world. So grab your favorite drink, and let’s explore this fascinating realm.

Understanding Legal Risk Prediction Models

Alright, if you’re new to this, legal risk prediction models might sound like something straight out of a sci-fi movie. Essentially, these models use historical data, algorithms, and sometimes even a pinch of AI magic to predict future legal risks. Imagine being able to foresee potential legal hiccups in a business transaction or an impending lawsuit. These models give companies a strategic edge, allowing them to make informed decisions and mitigate risks before they escalate. In today’s fast-paced world, where one misstep can cost millions, having a prediction tool is like having a map in uncharted waters.

Now let’s not ignore the dynamics at play here. Historically, legal decisions were made based on intuition and experience. While these are invaluable, legal risk prediction models bring cold, hard data into the picture. They analyze past cases, relevant laws, and even economic and social factors to deliver predictions. Think of them as specialized weather forecasters, but instead of predicting rain, they’re spotting legal storms on the horizon. And with their increasing sophistication, these models are becoming as indispensable in legal strategy as a good lawyer’s pen.

These prediction models aren’t just for the tech-savvy giants, either. Companies big and small are realizing the benefits. Small businesses, often with tighter budgets, can especially benefit from these models, as they can anticipate and sidestep potential lawsuits which might otherwise be crippling. This proactive approach doesn’t just save money but also enhances reputation. After all, in business as in life, being one step ahead can make all the difference.

Why Use Legal Risk Prediction Models?

1. Foreseeing Legal Obstacles: Legal risk prediction models can help foresee potential legal barriers before they become actual issues. This foresight allows businesses to strategize effectively and avoid costly legal battles.

2. Efficiency Boost: Integrating legal risk prediction models into a company’s operations can significantly enhance efficiency. By predicting risks ahead of time, businesses can streamline their processes and make informed decisions quickly.

3. Data-Driven Decisions: With legal risk prediction models, decisions are backed by data rather than gut feelings. This data-driven approach minimizes guesswork and boosts confidence in strategic planning.

4. Cost Savings: By accurately predicting risks, companies can allocate resources more effectively, potentially saving millions that could be wasted on preventable legal disputes.

5. Reputation Management: Legal risk prediction models not only help avoid lawsuits but also contribute to a company’s reputation. A track record of proactive risk management strengthens trust with clients and stakeholders.

Implementation Challenges

Diving deeper, as effective as legal risk prediction models are, they aren’t without their challenges. Implementing these models requires time, expertise, and a fair bit of investment. Imagine teaching a new language to someone; it takes effort but is immensely rewarding in the long run. Companies need the right infrastructure and skilled personnel to make the most of these technological marvels. It’s not just about acquiring the latest software; it’s also about nurturing a culture that values data-driven decision-making.

Another hurdle is data privacy. As legal risk prediction models sift through vast amounts of data, ensuring this data remains confidential and protected is paramount. With increasing regulations on data protection, organizations need to be doubly cautious. Nobody wants their sensitive information leaked while trying to avoid legal pitfalls!

Moreover, these models are not foolproof. They rely heavily on the quality of the data fed into them. If the data is outdated or biased, so too will be the predictions. Therefore, companies must maintain robust data collection and cleansing processes. While these challenges may seem daunting, the returns—predicting and preventing potentially catastrophic legal issues—are worth the effort.

Real-Life Applications of Legal Risk Prediction Models

Legal risk prediction models sound great in theory, but how do they work in real life? One enticing example is in contract management. By employing predictive insights, businesses can detect clauses that historically led to disputes, making adjustments proactively. It’s like having an early warning system for your contracts.

Another practical application is in compliance monitoring. Legal risk prediction models can alert a company when their operations start veering close to regulatory violations. This preemptive alert allows businesses to take corrective actions and avoid hefty fines. Also, consider a scenario like mergers and acquisitions, where these models can assess potential legal risks between merging companies, preventing future litigation.

In the ever-evolving field of intellectual property, prediction models are used to foresee patent litigation risks, measuring the feasibility and potential challenges of registering new patents. This boosts innovation by clearing the path of foreseeable legal roadblocks. Across domains, the ripple effect of these tools enhances strategic foresight and proactive management.

Benefits in Detail

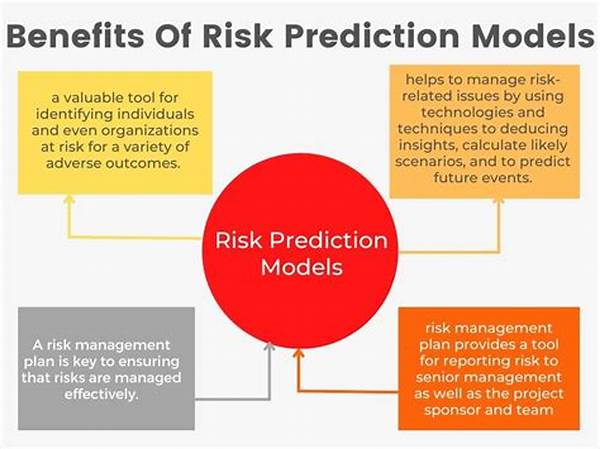

The benefits of legal risk prediction models are manifold. Firstly, they provide a competitive edge. Companies using these models are akin to chess players who can see several moves ahead, allowing them to navigate challenges adeptly. This edge translates into improved profitability and market standing.

Moreover, companies can significantly reduce insurance premiums by showcasing their risk mitigation strategies. Insurers love nothing more than a company that’s actively managing its risk profile. Additionally, the morale of internal stakeholders—employees, board members—often receives a boost knowing that their organization is staying ahead of the curve.

Lastly, legal risk prediction models foster a proactive culture. An organization attuned to future risks and adept at handling them becomes a benchmark in its industry. This unique culture often results in higher employee satisfaction and retention rates, as teams are motivated by being part of an industry leader.

Potential for Growth

With technology continually advancing, the potential of legal risk prediction models is vast. Machine learning and AI developments promise even more precise predictions. Imagine a future where these models not only predict risks but also suggest tailored strategies to counteract them!

Moreover, with globalization, legal complexities are increasing. Prediction models will evolve to accommodate multi-jurisdictional laws, providing nuanced risk assessments tailored to global operations. As technology and regulations evolve, so too will these models, integrating new variables and data sources.

There might come a day when no significant business decision is made without consulting a legal risk prediction model. It would become the norm in decision-making, just as financial forecasts have become. While the journey to widespread adoption might be gradual, its trajectory clearly outlines a future where risks are anticipated rather than reacted to.

The Future of Legal Risk Prediction Models

In wrapping up, legal risk prediction models are more than just trendy buzzwords; they represent the future of legal and business strategy. Embracing these models means accepting a fundamental shift from reactive to proactive risk management. As more businesses recognize the value of preventing issues before they start, these models will become as crucial as email or smartphones in the corporate toolkit.

As businesses become more complex and legal landscapes more challenging, legal risk prediction models will only grow in importance. They offer a way to navigate future storms with clarity and confidence, ultimately safeguarding both interests and reputations. Like any tool, their effectiveness depends on how they’re used, but for those ready to embrace them, the payoff is substantial.

So what’s next for these models? As they continue to evolve with technology, their accuracy, usability, and relevance will only increase. These models are here to stay, and they’re set to change the way the legal game is played. Whether you’re an entrepreneur, a legal expert, or someone just curious about the future, it’s time to keep a close eye on these influential models.