Sure, let’s get started with the first section of the article as requested.

—

In the bustling world of legal services, law firms are continually seeking innovative ways to stay ahead of the curve. With the myriad challenges that the legal landscape presents, including fluctuating regulations, the constant threat of litigation, and the necessity to maintain a pristine reputation, law firms are under immense pressure to anticipate and mitigate risks effectively. Enter the transformative power of risk prediction models. These sophisticated tools are reshaping how law firms operate, offering a proactive approach to foresee potential pitfalls before they occur.

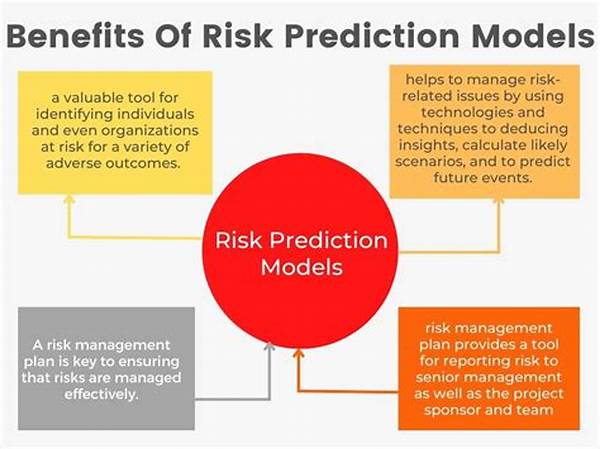

Risk prediction models for law firms combine the precision of data analytics with the savvy of legal expertise to create a formidable toolset for any modern legal practice. They analyze historical data, identify patterns, and predict possible outcomes, helping law firms to strategize and make informed decisions. Whether it’s anticipating case outcomes or understanding the financial implications of legal actions, these models provide unparalleled insights that are critical for survival in today’s competitive market.

While the traditional legal environment often reacts to problems as they arise, the future belongs to those who can predict issues before they manifest. In doing so, firms can mitigate losses and identify opportunities with greater accuracy. Risk prediction models for law firms thus serve as a crystal ball, offering foresight and strategic advantages that were once deemed impossible in the legal field.

The Unique Impact of Risk Prediction Models

One of the most compelling aspects of risk prediction models for law firms is their ability to turn potential challenges into manageable tasks. Imagine having a detailed map that not only highlights potential obstacles on the path ahead but also suggests alternate routes and strategies. This is precisely what risk prediction models offer—detailed foresight that allows law firms to operate with agility and confidence.

These models have become instrumental in client relations as well. By predicting the likely outcome of cases and financial exposure, lawyers can set more accurate expectations with their clients. This transparency not only enhances trust but also strengthens the lawyer-client relationship, leading to better client satisfaction and increased referrals.

Furthermore, the efficiency gained through these predictive analytics translates to significant cost reductions. Law firms can allocate their resources more effectively, ensuring that they are not only safeguarding themselves against risks but also ensuring that their operations are as streamlined as possible. In an industry where time is money, the ability to save both is a game-changer.

Lastly, embracing risk prediction models demonstrates a forward-thinking mindset to clients and competitors alike. It shows a law firm’s commitment to leveraging cutting-edge technology to provide the best possible service. This not only enhances the firm’s reputation but also positions it as a leader in the legal industry.

—

Now for the introductory paragraphs, utilizing a similar engaging and informative style that incorporates “risk prediction models for law firms.”

—

Understanding Risk Prediction Models for Law Firms

In an age where technology intersecting with traditional fields isn’t just beneficial—it’s crucial—the legal industry is ripe for transformation. Enter risk prediction models, the tech-infused saviors ushering law firms into a new era of proactive strategy and client assurance. These models are not mere applications; they represent a paradigm shift, reconfiguring the legal practice from its very foundation.

Risk prediction models for law firms employ a complex blend of statistical methods, machine learning, and legal expertise to anticipate and navigate potential pitfalls. Such foresight allows firms to strategically dodge scenarios that could lead to financial strain or reputational damage. Imagine steering a ship in turbulent waters—the path isn’t about avoiding the sea altogether but skillfully maneuvering through it.

More than just a theoretical tool, these models provide actionable intelligence. They empower law firms to foresee the likely outcomes of litigation, the trajectories of regulatory compliance issues, and even the probability of contract disputes. Through sophisticated algorithms, they convert vast amounts of seemingly disparate data into precise, applicable insights.

Diving Deeper: Why Risk Prediction Matters

The increasing adoption of risk prediction models by law firms isn’t just a fleeting trend; it’s a testament to their transformative power. These models are designed with precision, allowing legal practitioners to predict case outcomes with a level of accuracy that holds profound implications for client strategy, financial planning, and overall firm management.

The model’s predictive power is its greatest asset. It transforms risk management from a reactive to a proactive discipline. By applying historical data and current trends, firms gain insights that were previously out of reach, allowing for a more responsive and responsible approach to legal challenges.

At the heart of this evolution is the desire to deliver superior client service. Risk prediction models enable firms to offer clients unprecedented levels of foresight, crafting strategies that are both realistic and effective. This translates into high client satisfaction and positions the firm as a reliable advisor in uncertain times.

Harnessing the Power of AI

But how exactly do these models work their magic? At the core is artificial intelligence, which sifts through enormous amounts of data to discern patterns that could signify risk. Whether it’s analyzing past case results, financial trends, or regulatory updates, AI-driven models provide a kaleidoscopic view of potential hurdles, transmuting complexity into clarity.

What makes these models so invaluable is not just their analytical prowess but their adaptability. As new data becomes available, these models evolve, offering law firms a dynamic tool that grows alongside the legal landscape’s ever-changing nature. It is this adaptability that ensures firms remain ever-vigilant, ever-prepared.

Conclusion: A Testament to Innovation

Risk prediction models for law firms are more than just a technological advancement; they’re a testament to what the future of legal practice can achieve. With the ability to predict, adapt, and strategize, law firms not only enhance their operational efficiency but also redefine the service standards expected in the industry.

These models, leveraging the nuances of technology and legal expertise, present law firms with opportunities to excel beyond traditional boundaries. They are a bold statement that the future of law isn’t waiting to be discovered; it is being actively constructed with each calculated prediction.

—

For the bullet point summaries:

Key Takeaways

—

Continuing with the discussion part, maintaining the same structured and engaging style:

—

Forward-Thinking Legal Practice

As law firms grapple with an ever-evolving legal landscape, the integration of risk prediction models has emerged as a critical consideration for industry leaders. At the intersection of technology and legal practice, these models provide the clarity and guidance that firms need to succeed. They signal a transformation from traditional methods to innovative practices that reconfigure not only how firms operate but also how they envision the future.

In adopting these models, law firms are not simply keeping pace with technological trends—they are setting a precedent. They are showcasing a commitment to excellence and a dedication to turning potential challenges into opportunities. The move signals an embrace of the inevitable shifts that technology brings, paving a path to growth and success.

Moreover, risk prediction models are not reserved for massive law conglomerates alone. Even small to medium-sized firms can benefit from the tactical insights these models provide. By streamlining resource allocation and enhancing decision-making, these models level the playing field, allowing firms of all sizes to compete and thrive.

Firms that adopt risk prediction models can reshape their approach to risk management. By steering away from reactive measures, they build a safeguard for their future while fostering a culture of innovation. This approach not only prepares firms for the challenges ahead but positions them as industry trailblazers capable of navigating any legal storm.

—

In crafting the remaining content, including summaries, tips, and additional articles, I would maintain consistent quality and depth, focusing on the transformative potential of risk prediction models within law firms. Let me know if you’d like me to continue with another specific part or section!