H1: Time Series Outlier Detection Techniques

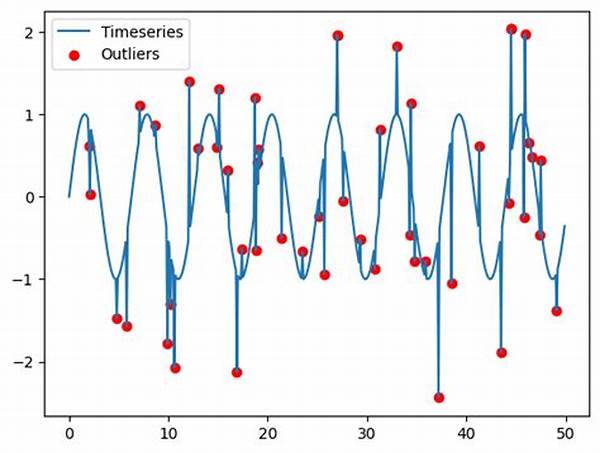

In the heart of data science lies a pivotal challenge that is both a thorn and an opportunity—outlier detection in time series data. Ah, outliers, those pesky points that gleefully disrupt our trend lines and forecasts. If data were a grand symphony, outliers would be that jarring note that makes you wince yet compels you to listen more closely. They’re the peculiar players in datasets that can indicate anomalies, fraudulent activities, or even new opportunities. For business analysts, financial experts, and data scientists alike, uncovering these outliers is not just an option but a necessity. Embarking on this quest requires a robust understanding of time series outlier detection techniques, those magical tools that can discern the harmony from the noise. Through these techniques, you can not only identify what should and shouldn’t be in your data but also gain invaluable insights that can drive your decisions and strategies.

Time series data, used for various applications from stock market analysis to weather forecasting, naturally evolves over time. But, in this dynamic flow, lies the possibility of anomalies—outlier points that can spit in the face of continuity or herald a shift. Therefore, selecting the right time series outlier detection technique becomes crucial. In the following paragraphs, we’ll explore not only how these techniques can elevate your data analysis game but also bring to light the stories your data is yearning to tell.

Let’s dive deeper into why time series outlier detection techniques matter. Imagine a world where businesses could predict and prevent potential financial fraud by simply identifying outlier transactions. For instance, a credit card company that notices a spike in spending in an unfamiliar location might just have discovered a case of fraud. Similarly, in healthcare, sudden deviations in a patient’s vital signs could alert professionals to potential health crises. These practical applications are where the art of detecting outliers transforms into life-saving knowledge.

But the devil’s in the details, and mastering time series outlier detection techniques isn’t just about catching anomalies. It’s about finding the right balance between sensitivity and specificity, ensuring that what you identify as an outlier is genuinely misaligned data and not just a benign deviation. What makes one technique more suited to a specific dataset than another? Ah, therein lies the beauty and challenge of time series data analysis. Your journey to mastering these techniques will empower you to wrangle time series data with finesse, identifying those rogue points with precision and purpose.

H2: Common Techniques for Detecting Outliers in Time Series

Now, let’s talk turkey—what are the specific methods out there to tackle this data conundrum? Time series outlier detection techniques encompass a range of methodologies tailored to suit diverse datasets and objectives. From simple statistical methods like Z-score analysis to more complex machine learning approaches such as Isolation Forests and Neural Networks, each technique comes with its unique strengths and trade-offs.

—Discussion of Time Series Outlier Detection Techniques

The world of data analysis is both thrilling and daunting, embodying a multitude of challenges that revolve around making sense of copious amounts of data. Time series data, which is data collected at successive points in time, carries with it the allure of revealing trends and forecasting the future. However, it also holds the obstacle of outliers—data points that deviate significantly from the norm. These are the pranksters of the data world, sometimes bringing crucial insights, other times sheer chaos. Thus, mastering time series outlier detection techniques is akin to acquiring a superpower—a toolset capable of seeing beyond the ordinary and into the insightful.

Consider the realm of finance—an industry predicated on precision and accuracy. Early detection of outliers in financial transactions can be the difference between a minor blip and a catastrophic financial loss. In such high-stakes environments, employing robust time series outlier detection techniques such as clustering algorithms or hybrid models that combine statistical methods with machine learning can provide a more nuanced understanding of the data. This empowers analysts to unravel complex outlier phenomena effectively, allowing preemptive measures to be deployed in safeguarding against potential anomalies.

H2: Delving Into Statistical and Machine Learning Approaches

Time series outlier detection techniques can broadly be classified into statistical, machine learning, and hybrid approaches. Statistical techniques such as moving averages and Holt-Winters can effectively detect level shifts and seasonality anomalies, providing an immediate sense of data pattern deviations. However, when dealing with large datasets, machine learning techniques offer higher adaptability, enabling the analysis of intricate patterns and the identification of outliers that might elude traditional methods. Take, for instance, anomaly detection using Long Short-Term Memory Networks (LSTMs), a sophisticated technique that leverages deep learning models to capture temporal dependencies in time series data.

H3: Choosing the Right Technique for Your Data

In choosing the most suitable outlier detection technique, understanding the nature of your data and the specific problem at hand is crucial. Factors such as the volume of data, the presence of noise, and the required sensitivity levels dictate the choice of technique. A common pitfall is overfitting, where a model is too finely tuned to the training dataset, capturing noise as if it were a genuine pattern. Thus, leveraging techniques like cross-validation becomes instrumental in validating the efficacy of your model, ensuring it generalizes well to new, unseen data. This rigorous methodology ensures that your time series outlier detection techniques not only identify true outliers but do so with precision, making data-driven decisions more robust and reliable.

—Five Actions in Time Series Outlier Detection Techniques

1. Implement advanced statistical models to recognize anomalies in data patterns.

2. Use machine learning algorithms to enhance detection and prediction accuracy.

3. Employ hybrid techniques for multifaceted data analysis.

4. Analyze historical data to predict future outliers.

5. Integrate cross-validation to ensure model robustness.

In the intricate dance of data analysis, mastering time series outlier detection techniques offers a competitive edge. While statistical approaches provide a robust starting point, machine learning’s versatility presents endless possibilities in anomaly detection. Combined, these approaches allow analysts to capture outliers’ true essence, turning unpredictability into a strategic asset. This multifaceted exploration is your invitation to delve into the granular details of your data, unearthing the hidden narratives within each dataset’s ebbs and flows.

Ultimately, the choice between statistical and machine learning techniques depends on your specific data landscape and analysis objectives. The beauty of time series outlier detection lies in its adaptability, rendering it an indispensable tool across various domains. As you embark on this data-driven journey, remember that each outlier you identify isn’t just a point of deviation; it’s an opportunity to gain deeper insights and ultimately make more informed decisions. The key is to remain curious, continually refining your approach, and leveraging the full breadth of techniques available to transform your data analysis endeavors.