Have you ever found yourself on the edge of your seat when making crucial business decisions, your fingers crossed, hoping you’ve accounted for every possible risk? We’ve all been there. The constant pressure of the unknown, the fear of unforeseen hiccups—these are familiar companions in the world of business. But what if there’s a way to tip the scales in your favor? Enter the world of enhancing risk prediction accuracy—a game-changer for anyone wanting to safeguard their endeavors.

In today’s fast-paced market, where every decision can make or break your business, having a reliable methodology for predicting risks is not just a luxury; it’s a necessity. Businesses with a clear vision of potential threats can maneuver around pitfalls, ensuring smoother operations and higher success rates. Imagine driving through a dense fog, your visibility limited, and then suddenly, the fog lifts, revealing a clear path. That’s the difference effective risk prediction can make. It replaces anxiety with assurance, guesswork with data-backed predictability, and potential losses with opportunities for greater gains.

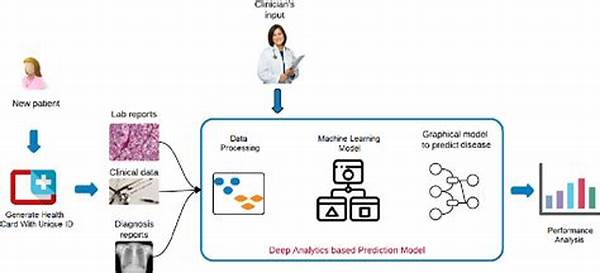

Not only is this more predictive approach valuable, but it also aligns with innovative tools and practices transforming industries in the digital age. It’s like swapping out a bow and arrow for a sleek sniper rifle in terms of precision. By utilizing big data analytics, machine learning, and artificial intelligence, businesses are now capable of dissecting mounds of data to parse out patterns and anomalies that were once invisible. Whether you’re in finance, healthcare, or retail, enhancing risk prediction accuracy is the secret sauce that keeps success stories brewing.

Tailoring Strategies to Enhance Risk Prediction Accuracy

Now that we’ve set the stage, let us delve into the tangible steps and strategies that can be adopted to enhance risk prediction accuracy within your business framework.

—

A Comprehensive Dive into Enhancing Risk Prediction Accuracy

In the ever-evolving sphere of business, the ability to foresee and mitigate potential risks sets industry leaders apart from their competitors. Enhancing risk prediction accuracy is the bedrock of sustainable success in the modern marketplace. It’s not about having a crystal ball, but about leveraging technology and analytics to anticipate and prepare for what the future holds.

Modern-day companies are no longer sitting ducks awaiting challenges. They are proactive, embracing advanced predictive analytics and machine learning models. Recent studies cite that companies adopting these technologies witness a 30% reduction in unforeseen risks, enabling them to pivot with agility when unexpected events unfold. These strategies don’t just identify risks; they quantify them, offering a clearer perspective on potential impacts.

The universal drive toward big data is essentially the backbone of enhancing risk prediction accuracy. By analyzing historical and real-time data, companies can spot recurring threats and emerging trends. Machine learning algorithms are trained to not only observe and report on these data sets but predict future occurrences, refining the accuracy of risk predictions over time. This isn’t merely a tool for multi-billion dollar corporations but is increasingly accessible to small and medium enterprises eager to build robust risk management frameworks.

However, technology alone isn’t enough. Human insight, seasoned judgment, and experience are integral to refining predictive models. As an innovative tech solution processes vast datasets, human intelligence interprets the data contextually, connecting the dots that technology might overlook. It’s the perfect synthesis of human and machine working in concert to produce outcomes that neither could achieve alone.

Risk mitigation is as much about culture as it is about systems. Companies fostering an environment where enhancing risk prediction accuracy is prioritized tend to excel. They create cross-functional teams, ensuring all departments from procurement to marketing are aligned in their understanding of risks. This integration guarantees that potential threats are identified in contexts that might otherwise remain in silos.

Ultimately, enhancing risk prediction accuracy is a journey, not a destination. It’s a continuous cycle of assessment, adaptation, and advancement, ensuring your business remains resilient amidst the uncertainties of an unpredictable world.

The Synergy of Technology and Human Insight in Risk Prediction

Strategizing for Enhanced Risk Prediction Accuracy

Examples of Enhancing Risk Prediction Accuracy

Steps Towards Enhancing Risk Prediction Accuracy

Stepping onto the path of enhanced risk prediction accuracy isn’t just about adopting new tools; it’s an organizational mindset shift towards a more proactive and data-driven culture.

To start, businesses should embrace a holistic data-gathering approach. Every interaction, transaction, and observation should be seen as a potential data point. This isn’t your ordinary data logging, but a comprehensive approach that pools data from every conceivable corner—customer feedback, sales numbers, marketing metrics, and even social media engagements.

Once data is collected, the magic begins with its analysis. This is where cutting-edge tech like machine learning and AI come into play. By rapidly processing massive volumes of data, these tools can identify patterns and anomalies, predicting potential risks before they manifest. The systems are designed to self-improve, learning from each new piece of data to enhance prediction accuracy over time.

The skepticism that often shadows technological advancements can be a hurdle. Yet, businesses that harness human expertise alongside tech see an amplification of results. It’s not just about numbers; it’s about understanding those numbers. Skilled analysts are crucial, interpreting data output and contextualizing it, breathing life into mere figures.

Communication and alignment within the organization can’t be overstated. Integrating the insights drawn from data into actionable strategies requires everyone on board. When an organization functions as a united front, a holistic understanding of risks permeates every decision and action.

Investment in predictive tools is an investment in the company’s future. Many businesses shy away, fearing costs or complexities. However, success stories from global giants exhibit how these tools pay dividends by protecting against financial threats and enhancing operational efficiency.

To truly excel, continuous learning and adaptation are crucial. The landscape of risk is ever-changing, and so too must be the methods we employ to predict them. Regular training and updates ensure that both your tech and human teams are not just keeping pace but leading the charge in risk prediction.

Bridging the Gap with Advanced Analytics

Tips for Enhancing Risk Prediction Accuracy

Conclusion

Embarking on a comprehensive strategy toward enhancing risk prediction accuracy is akin to investing in the most reliable raincoat – not just for today’s showers but for tomorrow’s storms. It’s a vital component of operational sustainability and business growth. As detailed throughout this guide, this journey involves integrating technology, fostering a data-centric culture, and maintaining an open-minded stance to innovations.

The humorous twists and turns of today’s business world might perplex even the savviest leaders. However, employing these strategies lets organizations sidestep pitfalls with ease and embrace opportunities with open arms. Transitioning to this predictive approach doesn’t just safeguard your business; it provides a competitive edge, equipping you to innovate, expand, and thrive in complexity.

Thus, as you reflect on your own company’s readiness for tomorrow’s challenges, consider this an invitation. Embrace the data, nurture the insights, and above all, be prepared to act on them. With each step towards enhancing risk prediction accuracy, you’re not just weathering the storm – you’re leading the charge, umbrella in hand, ready for whatever comes next.