- The Mechanics of Supervised Learning in Risk Management

- Discussion: Unpacking the Power of Supervised Learning in Risk

- Why Businesses Can’t Ignore These Techniques

- Actionable Insights: Embedding a Culture of Supervised Learning

- Six Key Actions for Implementing Supervised Learning in Risk Management

- Introduction to Supervised Learning Techniques for Risk

- Applying Supervised Learning Techniques for Enhanced Risk Management

- Seven Tips for Effective Supervised Learning in Risk Management

In today’s fast-paced, data-driven world, businesses continually face various risks that could impact their growth and profitability. From market fluctuations and financial uncertainties to operational and cyber threats, the landscape of risk is ever-evolving. Enter supervised learning techniques for risk, a beacon of hope for many organizations seeking to navigate these murky waters with precision and confidence. These techniques promise not only to preemptively identify potential threats but also to offer solutions that can mitigate them effectively. Harnessing the power of data, they transform raw information into actionable insights, allowing businesses to make informed decisions and stay ahead of potential pitfalls.

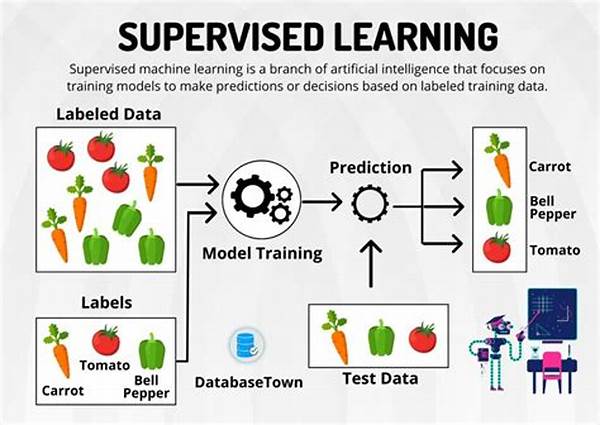

Imagine a world where your business decisions are backed by data-driven insights, reducing guesswork and enhancing accuracy. That’s what supervised learning techniques for risk offer. These methodologies involve training algorithms on labeled data to predict outcomes based on patterns. By analyzing historical data, these techniques can forecast future risk scenarios, empowering businesses to strategize proactively. Moreover, as the digital landscape becomes increasingly intricate, these techniques adapt, learning from new data to continuously refine their predictions.

Consider John, a fictional entrepreneur running a multinational corporation. With supervised learning techniques for risk, John can identify market trends, detect irregular patterns, and foresee potential downturns. This foresight allows him to adapt strategies in real-time, ensuring his company’s longevity and success. In essence, these techniques serve as a sophisticated compass, guiding enterprises through the labyrinth of modern business challenges.

The Mechanics of Supervised Learning in Risk Management

The core of supervised learning techniques for risk lies in their ability to model complex relationships between different variables. By training on historical datasets, these techniques can predict future events and assess their potential impact with remarkable accuracy. As businesses collect vast amounts of data daily, the challenge lies in extracting meaningful insights from this information, and supervised learning fills this gap efficiently.

—

Discussion: Unpacking the Power of Supervised Learning in Risk

Supervised learning techniques for risk offer a paradigm shift in how organizations perceive and manage potential threats. By leveraging machine learning algorithms, businesses can harness vast datasets, turning them into profound insights. These techniques not only enhance the ability to foresee risks but also optimize decision-making processes, transforming challenges into opportunities. But how exactly do these techniques work, and what makes them so invaluable in today’s business environment?

At the heart of supervised learning lies labeled data, where input-output pairs are used to train algorithms. This training process enables models to recognize patterns and relationships, which can then be applied to new, unseen datasets. Through this method, businesses can preemptively address potential risks, be it financial instability, operational hiccups, or market volatility. The beauty of supervised learning techniques for risk is their adaptability. As algorithms process more data, they refine their predictions, offering more nuanced insights.

Consider an example within the financial sector. Banks and financial institutions are constantly under threat from cyberattacks and fraudulent activities. By employing supervised learning algorithms, these institutions can detect anomalies in transactions that may indicate fraudulent behavior. This proactive approach not only minimizes financial losses but also bolsters customer trust and brand reputation. Additionally, these techniques aid in credit scoring by analyzing consumer data to predict repayment capabilities.

Why Businesses Can’t Ignore These Techniques

In the digital age, where data is both abundant and invaluable, supervised learning techniques for risk present a competitive edge. Companies equipped with these methodologies can swiftly navigate uncertainties, respond to dynamic market conditions, and innovate with confidence. Moreover, businesses can tailor these techniques to their unique needs, ensuring a customized approach to risk management.

The Tangible Benefits for Every Industry

Regardless of the sector, the benefits of supervised learning are manifold. For retailers, these techniques optimize inventory management by predicting demand fluctuations. Healthcare providers can enhance patient outcomes by identifying potential health risks sooner, while manufacturers can streamline operations by preempting supply chain disruptions. In essence, any industry that harnesses data can harness these techniques, driving efficiency and innovation.

Actionable Insights: Embedding a Culture of Supervised Learning

To truly capitalize on the potential of supervised learning techniques for risk, businesses must foster a culture of data-driven decision-making. This involves not only investing in the right technology and talent but also ensuring organizational buy-in. Leadership plays a crucial role in championing these initiatives, showcasing their benefits, and integrating them into core business processes. By doing so, companies position themselves at the forefront of innovation, ready to tackle future challenges with agility and foresight.

—

Six Key Actions for Implementing Supervised Learning in Risk Management

Introduction to Supervised Learning Techniques for Risk

Picture a world where the unknowns in business can be tamed and quantified. Much like a modern-day oracle, supervised learning techniques for risk hold the key to unlocking this potential. They act as an invaluable tool, not merely reducing potential mishaps but transforming them into strategic advantages. The implementation of these techniques promises a future where businesses of all sizes can thrive, undeterred by the shadows of uncertainty.

In the realm of financial services, retail, healthcare, and beyond, the advantages of deploying such strategies are becoming self-evident. Often misconceived as only relevant to tech-savvy organizations, supervised learning extends its capabilities across industries willing to leverage data as an asset. With an ever-increasing wave of accessible data, companies can not only ride this wave but also harness its power for unrivaled foresight.

Investments in these technologies are no longer just options but necessities for forward-thinking enterprises. From enhancing customer experiences to optimizing supply chains and pre-empting cyber threats—supervised learning techniques for risk are the linchpin of modern risk management strategies. Embracing these tools reduces the nebulous nature of risk, providing clarity and confidence for decision-making processes.

Whether you’re a burgeoning startup or an established conglomerate, the integration of supervised learning techniques can profoundly impact your risk management strategy. By providing a unique blend of analytical prowess and practical application, these techniques are reshaping the landscape of modern business. The key is not just in accessing these insights but in judiciously applying them to thrive in an unpredictable market landscape.

—

Applying Supervised Learning Techniques for Enhanced Risk Management

In a world teeming with uncertainty, businesses are seeking innovative methods to mitigate risks. Supervised learning techniques for risk present an enticing solution. These machine learning methodologies, rooted in analyzing historical data, provide a roadmap for organizations navigating potential threats, offering a blend of reliability and adaptability.

As we step further into the digital era, businesses are finding themselves inundated with data. This data holds the key to unlocking strategic insights, provided it is harnessed correctly. Supervised learning leverages this vast repository of information, identifying patterns and correlations that are otherwise imperceptible. By doing so, organizations can predict and, more importantly, prepare for an array of risk scenarios, from financial turbulence to operational setbacks.

H3: Overcoming Challenges with Supervised Learning

However, the path to mastering supervised learning techniques for risk is not devoid of challenges. Developing accurate predictive models requires high-quality data that is both relevant and comprehensive. Furthermore, organizations must culturally embrace data-driven decision-making, which might necessitate shifts in mindset and operations. Yet, the rewards for those who persevere are substantial, offering a competitive edge in volatile markets.

The crucial takeaway is that while technology forms the core of supervised learning, its triumph depends equally on the human element: the teams that interpret the data and the leaders who drive the strategic direction. As industries evolve, those willing to adapt and invest in these technologies will reap benefits not just in risk reduction but in enhanced growth and innovation.

—

Seven Tips for Effective Supervised Learning in Risk Management

Advanced Insights into Supervised Learning

In the context of thriving amidst uncertainty, supervised learning techniques for risk remain indispensable. By capitalizing on historical data and mathematical algorithms, businesses can pave a smoother path through uncharted territories. Not only do these techniques provide an edge in predictive accuracy, but they also cultivate resilience, arming enterprises with foresight that translates to tangible success.

Supervised learning techniques for risk are more than a trend; they are a testament to the power of innovation harnessed through data. As technological advancements continue to surge forward, organizations that integrate these methodologies into their core will undoubtedly find themselves at the forefront. Embracing these tools is no longer an option but a strategy imperative to make informed, strategic decisions in today’s ever-shifting market landscapes.